**Wheat Price Trends and Peripheral Markets; Charts and Commentary. More Sense Per Bushel.**

MarketBullets® Tuesday, February 3, 2026: Pre-Dawn

Listening online to many market commentaries one after another, I hear what sounds like capitulation, a phenomenon that is a feature of a long-term price low. It’s not a trading signal, but it is familiar and temporary, as over the years the market works out the unfeeling parameters of supply and demand. It is inevitable that such conditions should arise, but they do pass, even if much more slowly than we would like. There has never been any age where it was guaranteed that wheat prices would be stable and profitable. There are far more potential wheat producers in more diverse regions than ever in the past, but the market, if it is allowed to function freely, will arrive at a price that balances profitable production and consumption. The answer is purely pragmatic. We will do what we must.

We watch the behavior of the Chicago Soft Red Winter (SRW) wheat futures contract because it is the most observed and most liquid of all the global wheat markets. The movement of the price of SRW affects all other wheat. Chicago SRW is cruising along a very long and narrow sideways price channel. It’s a very long base-building exercise. Uptrends are launched from such long bases. The short-term pattern is upward, but will be challenged at every turn, as the trade has no easily visible fundamental factor upon which to make buying decisions. The most likely season to produce a new pattern is the spring. It’s just a little early in the northern hemisphere to be adding upward price risk premium. Patience.

One demand factor for wheat that gets overlooked is feeding. Friday afternoon’s USDA Cattle Inventories report showed all cattle and calves in the U.S. as of January 1 at 86.155 million head, down from 86.472 million a year ago and the smallest overall U.S. cattle herd since 1951, a mild price-negative for wheat.

Russian wheat exports for the current marketing year are estimated by the street at 28.0 million metric tonnes, about unchanged from last year.

India seeded a record 33.42 million hectares (82, 582,491 acres) of wheat this season.

The U.S. Dollar Index fell to a 4-year low last week. As of early Tuesday morning the index was steady to stronger, but still below most of the previous trade. It takes a vigorous move in the greenback to make a large difference in wheat price. It is tempting for market commentators to point toward dollar values to explain this price move or that, but it takes more than a day or two of dollar value variation to translate to a price mover.

The price of March Chicago wheat is parked right on top of the Box-o-Rox indicator line, as if it knew it was there. No trend = no action. Please stand-by.

Stay tuned.

-Gary

MarketBullets® Monday, February 2, 2026: Pre-Dawn

Diesel is down -5.6% from its January 30th highs.

The U.S. Dollar Index has bounced, recovering about half of recent declines to January 27th lows.

Gold has pulled back -18.8% from its all-time high only 3 sessions back, now trading more than $1,000 lower at $4,578 per Troy ounce. It is mildly astonishing how long it took to see some profit-taking emerge. Healthy markets must have some of this re-cycling to keep fit, else everyone gets on one side of the boat.

The Silver market bottom fell out, with a gasping -35% move since the highs on Jan 29th.

The S&P Stock Index has dropped back a paltry 2% from its highs a couple of sessions ago; not a heavy load just yet.

2-Year Treasury Notes are steady to positive in the middle of their 5-month range.

Chicago Wheat Soft Red Winter (SRW) futures have shied away from new highs and as of midnight Sunday have dropped back about 14 cents from its $5.44¾ high print at 4:30 AM January 30th. The very-short-term pattern remains in positive channel but is approaching another change of status for our Box-o-Rox (BoR) indicator. A significant low close below $5.28 in the SRW March delivery contract will move it back to “Execute Incremental Sales” status.

The winter weather that was the trade-talk trigger over the last week has not changed much, but the short-covering rally that it provoked may have taken enough price risk premium off the top to allow the wheat market to relax a bit.

U.S. all-wheat sales commitments now total 788 million bushels marketing-year-to-date, 18% ahead of the 2024-25 pace and almost 88% of USDA’s full-year target of 900 million bushels.

The market background is one of general profit-taking and re-calibration, with many major prices in retracement mode coming into the new week. The extent of this general adjustment market is not yet defined, so attention to the overall market tone must be heightened. The outside influence on wheat and other grain prices is decidedly negative, but so far, the effect has been minor.

Just as an observation: it seems that Trump’s propensity to make “abrupt changes to the status quo” in any relationship, including those with allies, has a “salutary effect” on responses among the Axis of Resistance (that’s a 2-dollar term for “makes their eyes go sanpaku as they consider what might happen next”). Spooky, but effective and never boring.

The little upward trend in wheat that began in the first week of January is still alive. There is little fundamentally that supports the idea of higher prices, but every major trend change starts with a shift in the wind direction. This is going to take some time to emerge. Opportunistic wheat marketing requires some deliberate trading-style moves, along with some patience when the movement is in our favor. We have to be prepared to give up some of the upward price gains in order to capture larger price increases, a thing that is easy to say and hard to do. Only by applying measuring tools and charts can we do this effectively, otherwise it is just a guessing game of little benefit.

Stay tuned, stay “agile, mobile and hostile” (as the coach used to say).

-Gary

MarketBullets® Friday, January 30, 2026: Pre-Dawn

March SRW finished Thursday around $5.39, up 0.65% from the previous session, with KC HRW and Minneapolis HRS wheat tacking on similar gains of 3-6 cents. We're sitting at eight-week highs after a 5.6% climb over the past month, but let's be clear—this is still muddy water, not blue sky. Year-over-year we're down, and many producers remain 40-50 cents below where their budgets need to be.

Friday morning trade is holding up steady as I type furiously away.

The specs have room to run on short covering in either direction. Data from last Friday’s COT report showed Managed Money (the “Funds”) net short at 110,700 contracts in Chicago wheat futures as of Jan 20th, so there's plenty of fuel for a technical bounce if the market decides to light it, but at the same juncture the market stands on the high edge of a price range that could be sold for a re-test of the old lows. This is a standard conundrum when trading at either edge of an established range.

Producers with an incremental slice of marketable wheat on the table have gained a few cents in recent days and are at a technical tipping point. The fundamental background is known to be full of wheat. The impulse is to hang tough for the next dime on a break-out to the upside, but given the well-known global picture, it’s a coin-toss, risking a return to early January’s lows. Box-o-Rox (BoR) is in “Suspend Sales” mode; Dealer’s Choice.

We're essentially running a dual-hemisphere freeze experiment, and nobody gets to peek at the results until March-April. Russia's southern breadbasket saw temperatures plummet to -15°C in key regions like Rostov in early January, with roughly 37% of their winter grains already in poor condition before dormancy. The problem? Patchy snow cover left crops exposed, with rapid temperature shifts causing "ice crusting" in the Central and Volga regions—a phenomenon that essentially suffocates plants beneath.

Meanwhile, back home, the U.S. faced its own arctic blast with wind chills hitting -55°F in Minnesota and Wisconsin. Critical wheat corridors in northern Illinois and Iowa have seen minus-35°F. The Central and Southern Plains lacked protective snow blankets when the freeze arrived. Some late-season snow provided partial protection, but the damage assessment won't be clear for another 4-6 weeks.

The market psych at work: Prices stabilized and even climbed despite record global production and the highest ending stocks in five years. Much of the negative news has already been priced in, and traders are shifting focus from current surpluses to potential risks in the upcoming 2026/27 season.

Moscow doubled its export quota to 20 million metric tons for February 15 to June 30 , signaling they want grain moving. But economics tell a different story: the strong ruble erodes profits on exports, with analysts noting exports could become more active if the ruble weakens to around 90 per dollar. In the context of a strengthened Ruble, external supplies remain unprofitable, especially for small and medium-sized producers. The government can set quotas all day—if the math doesn't work, the wheat stays home, but there is another harvest coming. Even if winterkill reduces Russia's 2026 crop, if old-crop wheat is backed up in storage due to unfavorable export economics, global available supply may expand; a scenario worth tracking.

Weekly export sales for the week ending January 22 came in at 558,201 MT, hitting the high end of expectations and running 22.39% ahead of last year. That's encouraging as long as we acknowledge the elephant in the room: the dollar sitting near four-year lows…is doing some competitive heavy lifting. When your currency's down, even mediocre wheat looks like a value play. Its good for any exports from U.S. sources.

March Chicago wheat has climbed above its 10 and 20-day moving averages, and that $5.01½ low from January 2nd looks increasingly solid. Buyers have shown up in the past around $5.45-$5.50 less than a dime above Friday morning’s trade. The March-May spread is leaning back toward smaller carry, sitting at about 60% of what it was last August.

Your playbook remains straightforward. This isn't the market for heroic calls or sitting on 100% inventory hoping for a miracle. The winterkill card is real, it's just unplayed. Consider protective puts if you're carrying significant unsold bushels into spring—think of it as insurance against the freeze damage turning out to be less severe than feared, a frequent event. Markets don't trade on last month's data, they trade on next quarter's uncertainty.

Next incoming certainties: WASDE Monday, February 10th

This report could acknowledge winterkill potential or hedge language and wait for field scouts to confirm damage. Don't expect aggressive production cuts yet—USDA will need more time and evidence. But even a hint of concern could trigger a scramble as shorts cover positions.

We're trading uncertainty premium against burdensome supply. The freeze damage story is legitimate on both sides of the Atlantic—it's just not confirmed yet. Historical precedent says periods of significant winterkill in the Black Sea during 2010 and 2012 led to multi-year rallies in global grain prices. We may be setting up for something similar, or we may simply be watching markets chase ghosts.

The trend is looking much healthier today than it was only a little more than a month ago.

The fundamentals manifest eventually. They always do. The question is whether you'll be positioned when they do.

One freeze-thaw cycle at a time. Stay tuned.

-Gabriel

PS – Noticeables: <Diesel> <Gold> <US Dollar Index> <Ruble VS Yuan> <2-Yr T-Note> <S&P>

Good hunting!

See “Archived Updates” in Top Menu for historical record of commentary.

North of Prescott, Washington

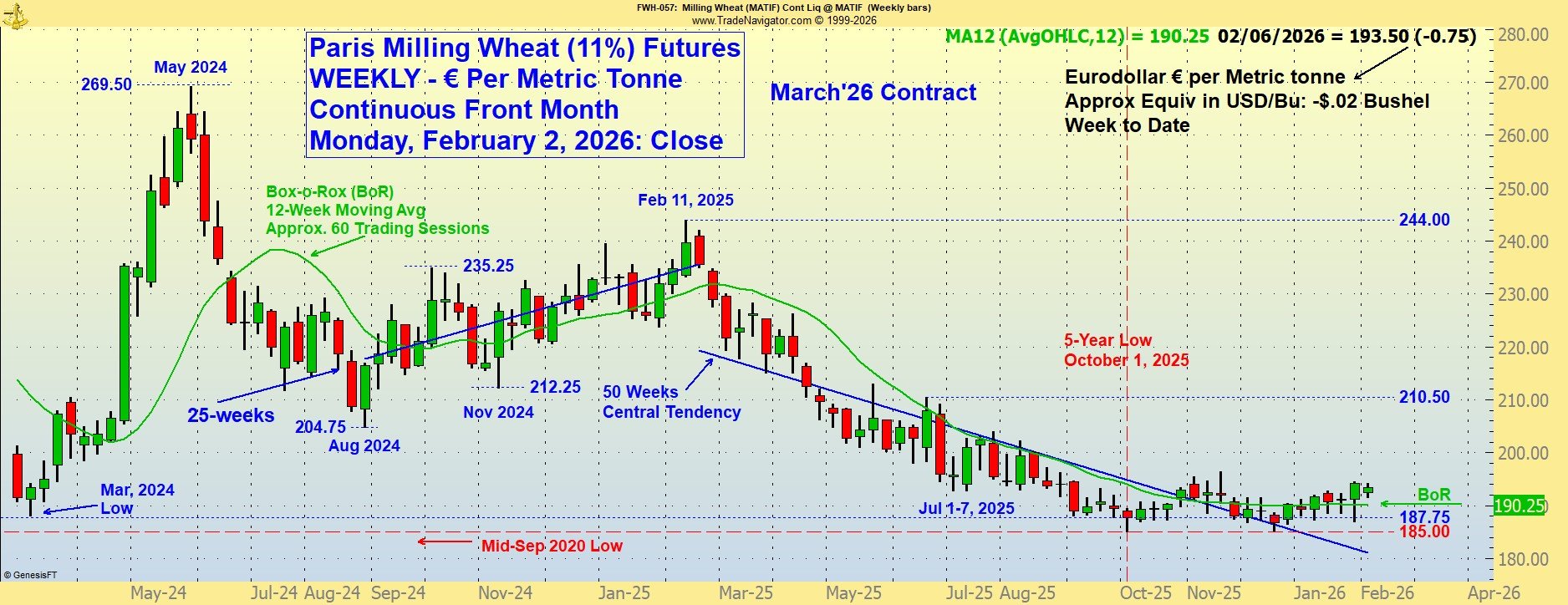

Paris Milling Wheat - Weekly

This Chart Updated End-of-Day Only

Minneapolis Hard Red Spring Futures

This Chart Updated End-of-Day Only

The Waitsburg Place

“Cultivators of the earth are the most valuable citizens. They are the most vigorous, the most independent, the most virtuous and they are tied to their country and wedded to its liberty and interests by the most lasting bands.” — Thomas Jefferson

Scroll down Below Text for Charts of Weekly Chicago SRW - Weekly KC HRW - Weekly Mpls HRS

***

Click on any of the following links:

<Paris Milling Wheat Daily> <U.S. Dollar Index Monthly> <WTI/Brent/Urals Crude>

Diesel Daily> <Wheat Spreads> <Gold> <Nat Gas> <Interest Rates>

<Box-o-Rox (BoR)> <Commitment of Traders> <Special Info Item>

<Weekly Ruble/Yuan> <Dry Bulk Ocean Freight> <Fibonacci Spiral>

RISK REMINDER: Always remember that the opinions and information on this site are intended as informative material and are believed to be drawn from reliable sources, but everything herein is subject to error and change without notice, without any guarantee as to accuracy or completeness. The management of physical grain positions and/or the use of futures, options, or other derivatives carries risks that are not appropriate for everyone, and thorough consideration of potential losses should be applied before taking or avoiding any trading action involving active markets. Any use of the content on this website is the sole responsibility of the consumer.

More Sense Per Bushel

Wheat Price Trends and Peripheral Markets; Charts and Comment

MARKETBULLETS®

Base (non-annotated) Charts Courtesy of Genesis Trade Navigator.

Chicago Soft Red Winter (SRW) Wheat Futures in 30-Minute Candles