MarketBullets®

See below for Chinese Yuan and Russian Ruble charts

Click HERE to return to Bullets

Base (non-annotated) Charts Courtesy of Genesis Trade Navigator.

Comment as of Thursday, October 16, 2025

The Dollar Index (DX), a multi-currency index that excludes the Chinese Yuan from its composition, has been in a broad, sideways pattern for the last 18 weeks. The potential for lower interest rates is a factor in Dollar weakness and the U.S. Federal Reserve seems inclined to allow the rates to slip lower. The Index does not include the Russian Ruble or the Chinese Yuan (Reminbi) among its components for calculation (see charts below). At present the Ruble is weakening against the Yuan and slightly against the Dollar, although the values are apparently considered to be in the “Management Targets”, set by Russia and China. For wheat prices from Russia, a weaker Ruble makes international prices for Russian wheat less expensive.

On June 12-13, the Russian government forced the U.S. Dollar off of Russia’s large central trading exchange (MOEX), as the Yuan is now designated as the Central Bank of Russia’s “Benchmark” currency. Now anyone in Russia or dealing with Russia who wishes to use the USD for trade must use interbank markets instead of open exchange trades on the MOEX to price Rubles or Dollars, making it significantly more expensive and less transparent. The direct effect on the Dollar Index is not large.

The new sanctions will also put pressure on others who trade with Russia, as there are terms that threaten to isolate entities that interact with Russian buyers of technology and other war-supportive goods. The downstream effects will emerge in the next few weeks and months.

The next technically definable upside target, at 108.81 on the Index is a retracement ratio of 61% of the entire move down from the September 2022 highs. A central factor is the rise in interest rates, ultimately a wheat price negative for U.S. origins, as it makes purchases more expensive through the foreign currency translation to U.S. dollars needed to complete transactions. The trend on a break above the 108.8 level will be confirmed as higher.

*A “Real Interest Rate” equals the observed market interest rate adjusted for the effects of inflation. The nominal US Real Interest Rate is at -1.19%, compared to +2.21% last year. The Current rate of inflation is higher than the yield of short-term treasury paper. The effect is to make the U.S. dollar and/or government notes and bonds less attractive in global markets versus any other currency or paper of nations whose real interest rates are positive.

The U.S. Dollar Index is heavily weighted toward European currencies. The Chinese Yuan should be followed alongside the Dollar Index for a more complete assessment of Dollar value in the world. (see below)

Comment as of Wednesday, October 15, 2025

Over the last 2.5 years, Chinese Yuan versus the U.S. Dollar* has created a rising triangle, indicating a general long-term strength of the U.S. Dollar versus the Chinese currency. A flat top pattern with rising lows underneath sets up a test of the horizontal top line to the upside. This is an old-school rising pattern, but the breakout of the top flat line is essential for its success. If it “fails” due to a breakdown below the upward-slanted line (depicting increasing buying support over time), the pattern would be broken and invalidated. The Dollar value in Yuan is currently testing that rising line (stronger Yuan possible ahead).

The big-picture Yuan chart displays a long term rising Yuan per Dollar value (Weaker Yuan) back to 2014-15 during which the Chinese exercised a series of devaluations of their currency in an attempt to increase exports and move toward a market-oriented economy, a move that ultimately proved to be correct. The current dynamic of the Chinese currency is in a challenge to the reserve currency status of the U.S. Dollar.

* The above chart is a “dollar chart”, showing Yuan per US Dollar. A rising price indicates more Yuan per Dollar hence a less expensive Yuan.

Comment as of…Thursday

The Ruble is strengthening in a pattern that suggests intervention. The implications of a stronger Ruble start with a greater ability to purchase war-related goods, but a rising Ruble is also a factor in pricing wheat, putting pressure on the Russian producers to compare crops. There is already talk that wheat planting will be lower this year in areas where alternative crops can be grown.

The Ruble is responding to Ukraine status. It has become clear that Putin is unlikely to give any diplomatic ground at all with regard to Ukraine. The situation is emerging into “NATO versus Russia”, as the U.S. is taking a less visible role. The most recent blatant message from Moscow was the bombing of Ukrainian infrastructure within only a few hours after Putin had a long telephone visit with President Trump in which an “agreement”(?) was reached to cease such attacks for a month. The only response was “sanctions”. Putin has no reason to relent.

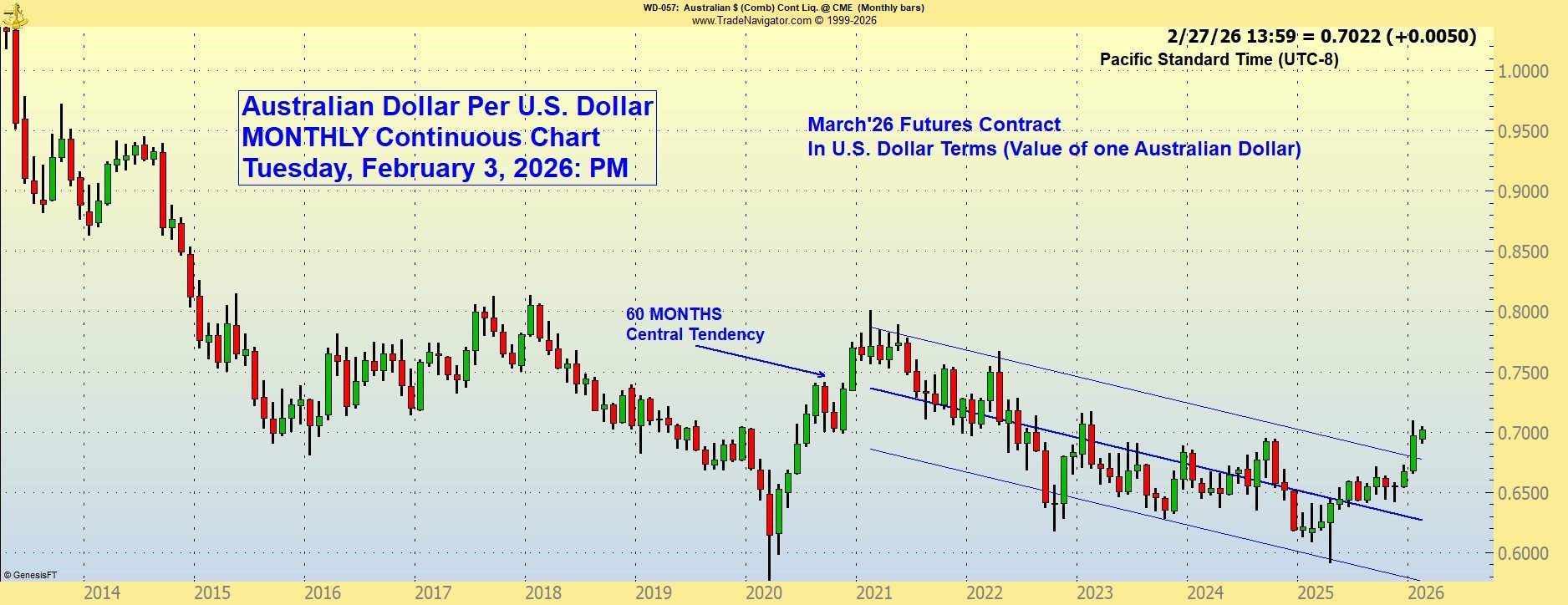

Australian Dollar

Click HERE to return to Bullets